Does Medicare Cover Hospice?

Everything you need to know about Medicare and hospice coverage.

Our content follows strict guidelines for editorial accuracy and integrity. Learn about our and how we make money.

Getting hospice care if you are terminally ill is crucial to improving your quality of life and overall well-being. However, people often wonder if their Medicare will cover these kinds of services or if they’ll have to pay for them out-of-pocket.

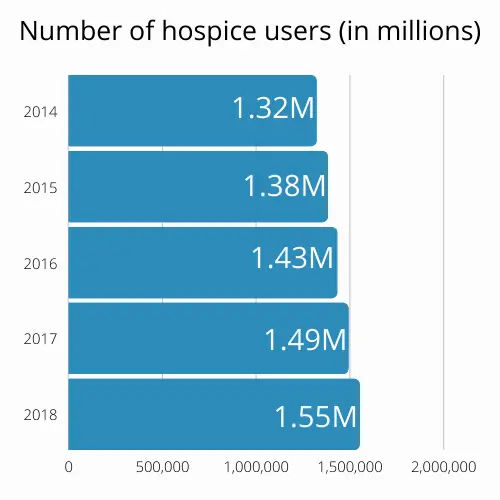

In 2020, the National Hospice and Palliative Care Organization (NHPCO) reported that 1.55 million Medicare beneficiaries received hospice care in 2018. This was a 4 percent increase from 2017.

If you’re wondering “Does Medicare cover hospice,” this article will help you understand everything about Medicare's hospice care coverage, what you should consider, and how you can get it.

As shown in this diagram, the number of people in hospices is steadily increasing every year. (MedPac March Report to Congress, Table 12-4)

What Is Medicare?

The federal Medicare program is a government-sponsored health care plan for individuals aged 65 or older, disabled people, and those that suffer from End-Stage Renal Disease (ESRD).

Medicare is made up of Part A, Part B, Part C (also known as Medicare Advantage), and Part D. There are also various Medicare Supplements Plans that range from A-N.

The Different Parts of Medicare

Medicare Part A refers to inpatient treatment and hospital care, and includes hospital stays, hospital treatments, and general nursing costs.

Medicare Part B relates to outpatient or general medical coverage and includes preventive treatments, doctors’ consultations, scans, and tests.

Part C/Medicare Advantage Plans are health cover plans offered by insurance companies that have contracts with Medicare.

These policies cover Part A, B, and D expenses, including costs for hospital care, prescription drug coverage, and doctors’ visits.

Standalone Part D (Prescription Drug Plans) cover self-administered prescription drugs. For example, medications for high blood pressure, pain tablets, and antidepressants.

Medicare Supplement Insurance, also known as Medigap, are licensed health insurance plans for people who have Original Medicare. These plans cover costs such as deductibles, coinsurance, and out-of-pocket costs.

Source: Pexels

What Is Hospice Care?

Hospice is a type of care whereby a team of specialized health care professionals take care and comfort someone who is terminally ill and approaching the end of their life.

Through Medicare, hospice care usually takes place in the patient's home or a health care facility like a nursing home.

Hospice care, sometimes known as palliative care or inpatient respite care, strives to manage a patient's terminal disease and pain while providing them with the most comfortable end-of-life care possible.

However, this care does not attempt to treat or cure the terminal illness; rather, it aims to manage it and improve the overall quality of a terminally ill patient’s life.

This type of care can also include spiritual and emotional care for the patient, as well as respite care for the family.

What Is Respite Care?

This concept refers to when trained providers offer short-term relief for the primary caregivers of the terminally ill patient. It can be arranged for an afternoon, several days, or multiple weeks. Care can be provided at home, in a health care facility, or at an adult daycare center.

Hospice care aims to ensure that the hospice patient will:

Be as comfortable and pain-free as possible

Be independent for as long as possible

Receive care from family and friends

Receive support through their final stages of life

Die with dignity

How Can You Qualify for Hospice Care and Coverage?

Original Medicare (Medicare Part A and Part B) does offer a hospice benefit, as long as your hospice provider is approved by Medicare and accepts Medicare rates.

A Medicare Advantage (Part C) policy will also cover hospice care. In order for a person on Medicare to get a hospice benefit, the patient must meet certain requirements:

The patient must be enrolled in Original Medicare (Part A and B)

The hospice provider must be Medicare-approved

The patient must be certified as terminally ill by a hospice doctor as well as the referring doctor, which means that the patient is only expected to live for six months or less

Hospice care is used for end-of-life comfort and is not an attempt to cure the patient's condition

The patient must sign a statement choosing hospice care over other Medicare benefits aimed at treating the illness

Sometimes the patient receiving hospice care can live past the doctor's six-month life expectation. If that happens, Medicare will continue paying for hospice care as needed.

In this case, the hospice medical doctor or the referring doctor will have to meet the patient in person and re-certify that their life expectancy is shorter than six months.

Medicare will pay for two 90-day benefit periods following the patient's initial enrollment in hospice care.

The beneficiary can then re-certify for an infinite number of 60-day benefit periods should they live longer than the initial 6-month life expectancy.

The hospice patient may change their hospice provider during any benefit period.

What Is a Benefit Period?

A benefit period is how Medicare Part A and Part B measures your use of hospital and skilled nursing facility (SNF) services.

A benefit period begins when the patient is admitted to a hospital or SNF. The benefit period ends when the patient hasn’t received any inpatient hospital care or SNF care for 60 consecutive days.

If the patient enters into a hospital or SNF after the first benefit period has ended, a new benefit period begins. For hospice care, Medicare will pay for two 90-day benefit periods following the initial enrollment.

There is no limit to the number of benefit periods that the beneficiary can use; however, the inpatient hospital deductible must be paid for each benefit period.

Tip: Looking for Treatment

If the hospice patient is considering attempting treatment as a cure for the underlying illness, talk to a doctor as hospice care can be ceased at any point.

If you are unsure about how hospice cancelation will affect your Medicare coverage, email your questions to Help@PolicyScout.com or call PolicyScout on 1-888-912-2132 to get personalized assistance from skilled Medicare consultants.

What Does Hospice Care Coverage Include?

Hospice care is compassionate end-of-life care that includes physical, emotional, social, spiritual, and medical support services to comfort individuals who are terminally ill.

According to Medicare, the following is covered for hospice patients:

All items and services needed for pain relief and symptom management

Medical, nursing, and social services

Drugs for pain management

Durable medical equipment for pain relief and symptom management

Aide and homemaker services

Other services to manage pain and other symptoms, as well as spiritual and grief counseling for you and your family.

Along with family and friends, the patient will also have the support of specialized teams that can include some or all of the following:

| Doctors | Physical and occupational therapists |

| Nurses or nurse practitioners | Speech-language pathologists |

| Counselors | Hospice aides |

| Social workers | Homemakers |

| Pharmacists | Volunteers |

How Much Does Hospice Care Cost?

If you have Original Medicare, your hospice care/treatment will be covered.

However, you will still have to pay your Medicare Part A and B premiums.

For pain and symptoms, you will though have to pay a copayment of up to $5 for each outpatient prescription drug.

If your hospice benefit doesn’t cover your medication, your approved hospice service should contact your policy provider to see if Medicare Part D covers it.

You may also be required to pay 5% of the Medicare-approved fee for inpatient respite care. This care is provided in a Medicare-approved facility so that the patient's daily caregiver can take a break.

Respite care permits a hospice patient to stay as an inpatient for a brief period of time on a regular basis. These short-term stays can last up to five consecutive days.

Some Examples of Treatments and Procedures that Will Help You Tell the Difference between ‘Inpatient’ and ‘Outpatient’ Services

Inpatient Care (Medicare Part A)

Hospital stays for an extended time

Medication administered by a health professional

Surgeries that require hospitalization

Childbirth

Rehabilitation services or a stay at a skilled nursing facility

Serious illness that needs monitoring in a hospital

Outpatient Care (Medicare Part B or Part D)

Consulting with your local doctor at their practice

Self-administered prescription drugs

A checkup by a medical professional

Bloodwork, X-rays, MRIs, and mammograms

An appointment with a physiotherapist

Some cancer treatments, like chemotherapy, which doesn’t require hospitalization

What Isn’t Covered by Medicare?

When a patient chooses hospice care, they have decided that they no longer wish to try to cure their terminal condition, and/or the doctor has determined that all treatment options have been exhausted.

Once hospice care is chosen, the hospital benefit will usually cover everything the hospice patient needs, but will not cover an attempt to cure the illness.

Once the patient's hospice benefit begins, Medicare won’t cover:

Treatment intended to cure the patient's terminal illness and/or related illness

Prescription drugs to cure the illness

Care by any hospice provider that wasn't set up by the medical team at the Medicare-approved hospice

Room and board

Unless arranged by your hospice team or unrelated to your terminal illness, care received as a hospital outpatient (like in an emergency room), care as a hospital inpatient, or ambulance transportation

Do Other Medicare Plans Cover Hospice Care?

There are many different types of Medicare plans, each providing coverage for different services. In relation to hospice care coverage, here is what each Medicare Plan offers:

Medicare Part A: Part A pays for hospital and hospice costs.

Medicare Part B: Part B covers outpatient medical and nursing services, medical equipment, and other treatment services. Part B can also cover hospital care depending on where you receive hospice care.

Medicare Part C (Medicare Advantage plan): Once your hospice benefit begins, everything will be covered by Original Medicare.

If you have a Medicare Advantage plan, you will continue to receive its benefits as long as you continue to pay the Part B premium, as well as any other premiums required by the Medicare Advantage plan.)

With a Medicare Advantage plan, the beneficiary can use the Part C policy for services that aren’t related to the underlying terminal illness.

Medicare supplement (Medigap): Medigap can help pay for services unrelated to the terminal illness. You won’t use Medigap to help cover hospice care as Original Medicare already supplies coverage.

Medicare Part D: Despite hospice enrollment, Part D prescription drug coverage will still cover any medication/s that are unrelated to the terminal illness.

Where Can You Learn More about Medicare and Coverage Plans?

To ensure that a patient's final months are as peaceful as possible, PolicyScout wants to help find the best hospice coverage in the event that it's needed.

If you are looking for up-to-date and accurate information about Medicare, Medicare Advantage, or anything Medicare-related, head to PolicyScout’s Medicare hub. If you want to find a plan, read our 2022 guide to find great Medicare Advantage cover.

If you need more guidance, send your questions to Help@PolicyScout.com or call us at 1-888-912-2132 to get personalized assistance from one of our skilled Medicare consultants.