Lemonade Home Insurance Review 2022

Read our review of Lemonade, their home insurance options, and how they compare with other home insurance companies in the United States.

Our content follows strict guidelines for editorial accuracy and integrity. Learn about our and how we make money.

Who Is Lemonade?

Since 2015 Lemonade insurance has offered a range of insurance including homeowners insurance to the U.S. market and three European countries.

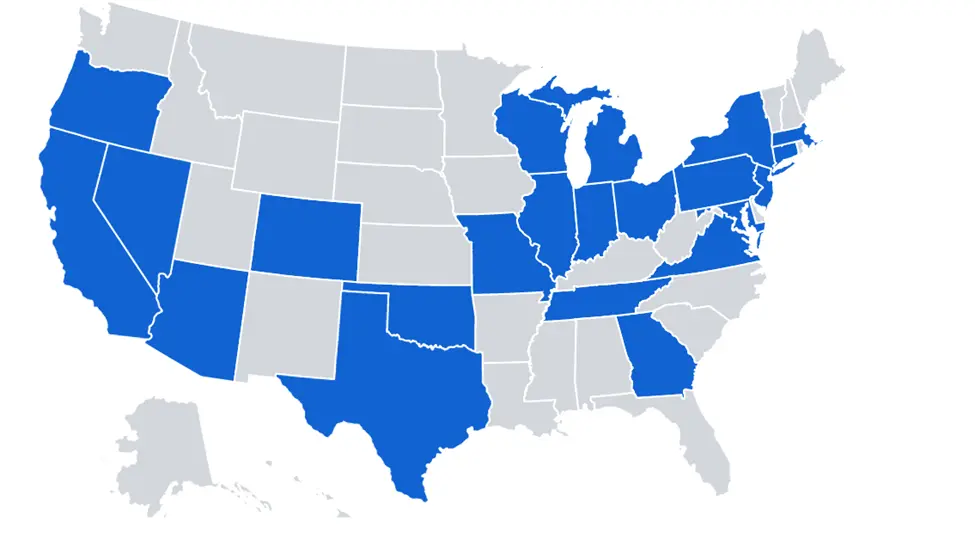

The company currently offers insurance in 23 states but is quickly expanding. It will soon serve more states in the U.S. and most European countries.

Lemonade insurance has a refreshing approach to insurance, and provides all its services via its website and mobile apps.

Suppose you are considering insurance for your home and are looking for an affordable company with a simple, easy-to-understand process. In that case, Lemonade may be a good option for you.

What Are the Benefits and Limitations of Lemonade Home Insurance?

Every insurance company has its advantages and disadvantages. Let’s take a look at what these are with Lemonade.

Benefits

✅ Their insurance rates are low compared to other home insurance companies.

✅ Their insurance offering is transparent.

✅ 40% of your unused premiums are donated to charity.

✅ They provide an efficient live chat feature during the quote process.

✅ You can get your homeowners insurance quote easily online.

✅ Lemonade has a simple-to-use mobile app.

✅ Almost a third of claims are handled instantly.

✅ Plans start at just $25 per month.

Limitations

❌ Insurance coverage is only available in 23 states.

❌ There are not many home insurance coverage options available.

❌ It’s sometimes difficult to reach customer service by phone.

Is Lemonade Available in Your State?

Homeowners insurance from Lemonade is available in 23 of the 50 U.S. states.

| Arizona. Colorado. Connecticut. District of Columbia. Georgia. Illinois. Indiana. | Iowa. Maryland. Massachusetts. Michigan. Missouri. Nevada. New Jersey. New York. | Ohio. Oklahoma. Oregon. Pennsylvania. Tennessee. Texas. Virginia. Wisconsin. |

Lemonade and How It Ranks with Leading Credit Rating Agencies

A rating agency, also known as a third-party rating agency, assesses how financially strong companies and government institutions are.

AM Best, Moody’s, Standard and Poor (S&P), and J.D. Power are all top rating agencies, but unfortunately, these agencies do not have ratings for Lemonade on their websites.

The following companies, which are also reputable rating agencies, have provided ratings:

Better Business Bureau (BBB)

BBB, founded in 1912, is a private, nonprofit organization. They help American, Canadian, and Mexican consumers find trustworthy businesses and charities.

Although BBB gives Lemonade an A- rating, it also shows 68 customer complaints in the past 3 years. This is more complaints than it received through other rating agencies.

National Association of Insurance Commissioners (NAIC)

The National Association of Insurance Commissioners regulates the insurance industry in the U.S.

Their opinion on insurance companies helps to regulate the insurance industry. The NAIC typically rates an insurer based on the number of complaints they receive.

The complaint index for Lemonade stands at 0.81, which is lower than the national average score of 1.00.

This means that Lemonade policyholders have submitted fewer complaints than other home insurance companies of the same size.

ConsumerAffairs

ConsumerAffairs, founded in 1988, is an American customer review and consumer news platform.

They help consumers find information about companies to make better buying decisions.

Lemonade receives a healthy 5-star rating from ConsumerAffairs. This means they have received a low number of complaints from policyholders.

They have some excellent reviews on their website from consumers who have bought their homeowners insurance through Lemonade and had positive claims processing experiences.

What Types of Homeowners Insurance Is Available Through Lemonade?

Homeowners insurance provides six types of standard coverage that you can take advantage of when you take out a home insurance policy with Lemonade.

The six common coverage types are available from any homeowner insurance provider. They include:

1. Dwelling coverage

This is an essential type of home insurance coverage that pays to repair or rebuild the overall structure of your home.

For example, if your home is burned by fire, dwelling coverage will pay up to the policy's dollar limit. A dollar limit is a maximum amount an insurance provider will pay out on a policy.

Types of dwelling coverage include:

Wind and hail.

Vandalism.

Fire, lightning, and smoke.

Freezing, snow, and ice.

Volcanic eruption.

2. Other structures

‘Other structures’ insurance, or ‘dwelling extension insurance’ as it is sometimes called, covers structures that are not attached to your home.

Like dwelling insurance, other structures insurance covers damage from fire, vandalism, wind, hail, and snow.

Other structures insurance covers the following structures:

Fence.

Detached garage.

Driveway.

Shed.

Gazebo.

Guesthouse.

3. Personal property

Personal property insurance, also known as ‘Coverage C’ in many home insurance policies, includes the cost to repair or replace personal belongings such as:

Furniture.

Clothing.

Cellphones, tablets, and laptops.

Crockery and kitchen appliances.

Jewelry.

TVs.

Personal property insurance will not pay for cars as this is covered under Lemonade's auto insurance.

4. Loss of use or additional living expenses

Loss of use insurance, also known as ‘additional living expenses insurance,’ pays for hotel stays and other costs if you cannot stay in your home due to a covered reason such as a fire.

Depending on the limits of your home insurance policy, loss of use insurance can pay out living expenses up until your home is fully repaired or up to the policy dollar limit.

Loss of use insurance will also pay out if your home isn’t accessible. Maybe the police have blocked off your street because of a disaster, or there has been a flood or hurricane and it is not safe to be at home.

Loss of use insurance usually covers the following expenses:

Hotel stays.

Restaurant meals.

Apartment or house rentals.

Groceries.

Pet boarding.

Transportation fees.

Parking fees.

Laundry expenses.

Moving and storage costs.

5. Medical payments

This insurance helps pay for minor medical expenses for visitors who accidentally get hurt while being on your property, whether inside or outside your home.

This cover does not include members of your own household.

It does not matter whose fault the accident is. Medical payments insurance acts as a financial shield for any minor injuries. It may prevent an injured person from suing you for compensation.

Medical payments insurance includes cover for:

ER visits.

Hospital stays.

Surgeries.

Physical therapy.

X-rays.

Ambulance rides.

Funeral services.

6. Liability coverage.

Liability coverage provides insurance to you if someone gets hurt or there is damage to other people’s property (or their personal belongings) because of your actions. This insurance covers you whether the loss occurs on your property or elsewhere.

Home Insurance Add-Ons through Lemonade

You can choose to have additional cover added to your home insurance through Lemonade.

This will help protect you from unforeseen events, and most add-on insurance options are not expensive for you to include.

Here are some of the most common add-ons to home insurance with Lemonade:

Extended reconstruction

If you need to rebuild your home after a fire, flood, or earthquake, this cover gives you an additional 25% or 50% of your dwelling coverage.

Swimming pool insurance

Covers any injuries that may happen when people use your pool.

Buried utility

This coverage is also known as ‘service line coverage.’ Lemonade will pay you up to $10,000 to repair or replace underground lines that run from the street to your property.

These underground lines can include sewage, water, electrical, gas, and power lines.

You'll be covered for service line damage resulting from breakdowns, wear and tear, freezing, artificial currents, and excess weight.

Water backup coverage

This type of cover protects your home and personal property from water damage resulting from sewage or sump pump backups.

The damage to your home’s structure, like the walls or floors, and your belongings, is covered up to either $5,000 or $10,000, depending on the coverage amount you choose.

Equipment breakdown

You can cover your appliances and electronics with insurance, including mechanical breakdown and electrical power surges. With Lemonade, you will be covered up to $100,000.

Foundation water backup

This insurance covers cracking, seeping, or leaking foundations caused by water. This coverage is usually excluded in standard homeowners insurance coverage.

Extra coverage

Extra coverage insures valuables like musical instruments, artwork, jewelry, cameras, and bicycles. This cover helps you if you damage these items accidentally.

Insurance Discounts from Lemonade

Lemonade offers a limited number of insurance discounts. Depending on where you live, you may be able to add these discounts to your insurance policy.

Speaking to your Lemonade insurance representative will help you confirm what discounts you will be eligible for.

Some of these discounts include:

Multiple product discounts: When you bundle various insurance products such as home, auto, and life insurance, you may be eligible for a discount.

Protective device discounts: If you install a home security system such as home monitoring and burglar alarms, you may be able to receive a discount. You may also get a discount for installing a fire or smoke alarm.

Annual payment plan: If you pay your homeowners insurance premium for a full year upfront, you will be eligible for a discount.

Lemonade offers other discounts depending on the state you’re in. You will need to speak to an agent about what discounts are available in your state.

What Will Your Experience with Lemonade Be Like?

All insurance companies work a little differently. How pleasant and easy they make your experience with them is very important, because your time is valuable.

Let’s look at how it is to work with Lemonade insurance.

Signing up for insurance

Signing up with Lemonade for your homeowners insurance is fast and easy. You can sign up through their website or mobile app. Lemonade says that the process takes just 90-seconds.

Step 1: Download the appYou can download the Lemonade app through Apple App Store or Google Play Store.

Step 2: Share your detailsYou will need to enter your name, surname, and email address, and a chatbot will lead you through the rest of the process.

Managing and customizing your insurance

Your homeowners insurance premium will be calculated just for you.

The amount you will pay depends on a few factors, including:

The value of your home.

How your home is constructed.

Your insurance history.

Any previous claims.

Your Lemonade insurance policy is accessible via their mobile app and their website. With Lemonade, managing your insurance policy very easy, which makes them different from their competitors.

The claims process

To make an insurance claim, you will need to open your app and select the ‘File a Claim’ option.

You will then be guided through the rest of the short process.

After you complete the claim report on the app, you will be asked to enter your bank account information.

Once your claim is approved, Lemonade will pay you out.

While other insurance companies can take as long as 30 days to process a claim, Lemonade generally takes just minutes.

For customer service, you can get help via Maya, the chatbot on Lemonade’s website or app. You can also send an email on their website, or if you want to speak to an agent, you can call 1-844-733-8666.

Digital experience

Lemonade makes it easy to apply for cover, manage your policy, and process claims via its website and mobile app.

Maya the chatbot provides a personalized service without you ever having to hold the line to speak to a call center agent.

Lemonade offers a service that is quick, convenient, and easy to understand. For anyone happy to work through an app and not an agent, Lemonade may be a good option.

What Have Customers Said about Lemonade?

Lemonade generally has positive reviews. Below we share what has been said about Lemonade on these websites:

ConsumerAffairs

Lemonade has achieved 4.8 out of 5 stars with ConsumerAffairs. This means that the number of customer complaints they have received is low.

ConsumerAffairs is one of the leading consumer watch organizations in the U.S. Their ratings can be trusted because many consumers voice their opinions about companies on this platform. Each review is moderated to confirm its quality and helpfulness.

| Lemonade Home Insurance | Allstate Home Insurance | State Farm Home Insurance | Progressive Home Insurance | |

|---|---|---|---|---|

| ConsumerAffairs Satisfaction Rating | 4.7 stars | 3.9 stars | 3.9 stars | 3.8 stars |

National Association of Insurance Companies (NAIC)

The complaint index for Lemonade insurance stands at 0.81. This is lower than the national score of 1.00.

The NAIC score means that policyholders at Lemonade have recorded fewer complaints than other homeowners insurance companies of the same size.

On the NAIC website, you can review the number of complaints received by Lemonade insurance.

California logs the most complaints at 23, followed by Texas at 5, New Jersey at 3, Oklahoma at 2, and 1 respectively for the following states:

Colorado.

Georgia.

Maryland.

Missouri.

New York.

Washington.

Lemonade Cancellation Policy

You can cancel your policy at any time, and they will give you a refund for the remaining period you’ve paid for.

Here are the steps to cancel your homeowners insurance with Lemonade:

Online

You can cancel your policy quickly through the Lemonade website or app. The app can be found on the Apple App Store or Google Play Store.

On the phone

You can also cancel using a more traditional method. Lemonade makes it a pain-free process with 5 easy steps:

Call Lemonade customer service at 1-844-733-8666.

Ask to speak to an agent.

Verify your account information.

Request cancellation of your policy.

Ask if any charges will be incurred.

By email

You can email help@lemonade.com and ask the support team to cancel your account.

You will need to provide your:

Name.

Surname.

Policy number.

Homeowners Insurance Companies - How They Compare with Lemonade

Lemonade and State Farm home insurance

| Lemonade | State Farm | |

|---|---|---|

| State availability | Lemonade home insurance is available in 23 states including Washington D.C. See in which states Lemonade home insurance is available on their website. | State Farm is available in 50 states, including Washington D.C. |

| Discount offers and bundle | -Protective devices discount for devices such as smoke alarms, burglar alarms, and deadbolts in your home. -Bundling policies by buying more than one type of policy with Lemonade, such as home and pet insurance. | -Bundling discounts for various insurance products. -Home security insurance discount for fire, smoke, or burglar alarms. -Roofing discount for hail-resistant or class 4 shingles. -Higher deductibles increase the out-of-pocket amount you are responsible for if you need to claim. |

| Add-ons | -Extra valuables. -Swimming pool liability. -Significant other. -Water backup. -Appliance breakdown. -Extended reconstruction costs. | -Water backup coverage. -Earthquake coverage. -Flood insurance. -Off-premises structures coverage. -Personal injury liability coverage. -Home systems protection. -Identity theft coverage. -Energy efficient upgrade coverage. -Umbrella coverage. -Service lines coverage. -Mold coverage. |

| Communication channels | You can contact Lemonade Insurance in the following ways: Email: help@lemonade.com Phone: 1-844-733-8666 | State Farm has multiple communication channels for you, they include: Email: Online form Phone: 1-800-782-8332 Mobile App: Apple App Store and Google Play Store |

| PolicyScout Star Rating | 4.6 | 3.8 |

Lemonade and Liberty Mutual home insurance

| Lemonade | Liberty Mutual | |

|---|---|---|

| State availability | Lemonade home insurance is available in 23 states including Washington D.C. See in which states Lemonade home insurance is available on their website. | Liberty Mutual is available in 50 states, including Washington D.C. |

| Discount offers and bundle | - Protective devices discount for devices such as smoke alarms, burglar alarms, and deadbolts in your home. - Bundling policies by buying more than one type of policy with Lemonade, such as home insurance and pet insurance. | - Online purchase discount - save 10% when you get your home insurance using Liberty Mutual’s website - Bundle discounts - save $947 on customized home and car insurance. - Paperless policy discount when you get your policy information and bills via email rather than post. - Safe homeowner program lets you save on your premiums if you are claim-free for 3 years. - New roof discount for when you replace your roof. - Newly purchased home savings. |

| Add-ons | - Extra valuables. - Swimming pool liability. - Significant other. - Water backup. - Appliance breakdown. - Extended reconstruction costs. | - Flood insurance. - Earthquake coverage. - Hurricane coverage. - Personal property coverage. - Replacement cost for belongings. - Blanket jewelry coverage. - Inflation protection. - Water backup and sump pump overflow coverage. - Identity fraud expense coverage. |

| Communication channels | You can contact Lemonade Insurance in the following ways: Email: help@lemonade.com Phone: 1-844-733-8666 | You can contact Liberty Mutual in the following ways: Email: AskLiberty@LibertyMutual.com Phone: 1-800-290-8711 Online Account: Log In |

| PolicyScout Star Rating | 4.6 | 3.5 |

Lemonade and Allstate home insurance

| Lemonade | Allstate | |

|---|---|---|

| State availability | Lemonade home insurance is available in 23 states including Washington D.C. See in which states Lemonade home insurance is available on their website. | Allstate is available in 50 states including Washington D.C. |

| Discount offers and bundle | - Protective devices discount for devices such as smoke alarms, burglar alarms, and deadbolts in your home. - Bundling policies by buying more than one type of policy with Lemonade, such as home insurance and pet insurance. | - Multi-policy discount - you can save up to 25%. - Easy pay plan - you can save 5% by signing up for automatic premium payments. - Claim-free discount - up to 20% saving for no-claims and customers who switch to Allstate. - Protective device discount for alarm systems and smoke detectors. - Early signing discount of 10% for policyholders who signed up for a new policy at least 7 days before their existing policy expires. - Welcome and loyalty discount saving of 10% annually for switching from another insurer. - Home buyer discount for recent homebuyers or buyers of a newly constructed home. - Responsible payment discount for paying on time or paying in full. |

| Add-ons | - Extra valuables. - Swimming pool liability. - Significant other. - Water backup. - Appliance breakdown. - Extended reconstruction costs. | - Personal umbrella policy. - Earthquake insurance. - Flood insurance. - Home-sharing insurance. - Water backup. - Scheduled personal property. - Business property. - Sports equipment. - Yard and garden. - Electronic data recovery. - Musical instruments. - Green improvement reimbursement. |

| Communication channels | You can contact Lemonade Insurance in the following ways: Email: help@lemonade.com Phone: 1-844-733-8666 | You can contact Allstate Insurance in the following ways: Online Login: Fill form Phone: 1-800-669-2214 Mobile App: App Store and Google Play Store |

| PolicyScout Star Rating | 4.6 | 4.6 |

Tips for Buying Homeowners Insurance

Choosing homeowners insurance is something that you need to take very seriously.

When shopping for the right insurance provider, it’s important to look at what is covered by the policy you select.

If a disaster strikes—like water damage, a fire, a flood, or an earthquake—you could be left with significant out-of-pocket expenses you may not be able to afford.

The right homeowners insurance policy will help put your mind at ease.

Get the right coverage

Although it may be tempting to get the least amount of home insurance coverage to save a few dollars, this may not be a good idea. Instead of focusing on price, focus on coverage and quality.

Understand your policy

Read your home insurance policy carefully to be absolutely sure of what is and is not covered.

If there is something in your policy that should be covered but you can’t find it in the wording, contact your insurance company to have your coverage explained to you.

Periodically review your policy

Make sure you review your home insurance policy from time to time. This will ensure you are getting the best rates.

Ask your home insurance company for benefits and loyalty discounts if you have been a customer for over a year.

Check your home insurance company’s rating

A rating is an independent assessment that is usually provided by rating agencies like AM Best and Standard and Poor (S&P).

A good rating means that a company can meet its financial and claim obligations even after a widespread disaster.

Check additional protections

Make sure you understand what other coverage options are available to you through your home insurance provider.

For areas where wildfires, flooding, hurricanes, and earthquakes are a risk, you may want to be insured for these natural disasters.

Look for discounts

There are typical home insurance discounts that nearly all companies offer, but they aren’t standardized across the industry.

Check for discounts for security systems, water leak sensors, smoke detectors, etc. Also, see whether the company will offer discounts for upfront premium payments, no-claims discounts, and multi-policy savings.

Our Policy Scout Verdict on Lemonade Home Insurance

Lemonade is a great choice for easy and quick homeowners insurance.

When it comes to convenience, Lemonade leads the insurance industry from its easy-to-use website and app to its fast claims process.

It may not offer the same coverage as other insurance companies, but its rates are very affordable.

As a company, Lemonade does not receive many complaints, so they are a good option if you are looking for good service, based on the feedback that other policyholders have given.

At the time of writing this review, Lemonade is only available in 23 states, but you can expect them to be available in your state soon.

We feel Lemonade is a stable insurance provider worth investigating further to see if their home insurance solutions meet your needs.

Frequently Asked Questions about Lemonade Home Insurance

How do I buy Lemonade homeowners insurance?

Lemonade homeowners insurance policies are sold online through their website or mobile apps. Download the app on the Apple App Store or Google Play Store, or visit https://www.lemonade.com/homeowners to check prices and apply for cover.

Why is Lemonade homeowners insurance so cheap?

Lemonade can provide lower insurance prices as it has fewer costs to cover. These costs include call center agents, for example. Most interactions are done via their website and mobile app.

Is Lemonade homeowners insurance good at paying claims?

Lemonade offers claims decisions in minutes, unlike the industry standard 30-day turnaround time. According to sources such as the ConsumerAffairs website, their claims payout is reportedly good.

What does Lemonade home insurance not cover?

Many things that aren't covered under standard insurance policies are typically the result of properties being neglected and badly in need of routine maintenance.

Termites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered.

Is Home Insurance from Lemonade tax deductible?

Home insurance premiums from any insurer can’t be deducted from your income taxes, according to the Internal Revenue Service (IRS). But, you can deduct it from your mortgage insurance premiums.

Need Help?

You can reach us at 1-888-912-2132 or send an email to Help@PolicyScout.com. We’re standing by to help you with any questions that you have.