10 Things You Can Do To Improve Your Credit Score

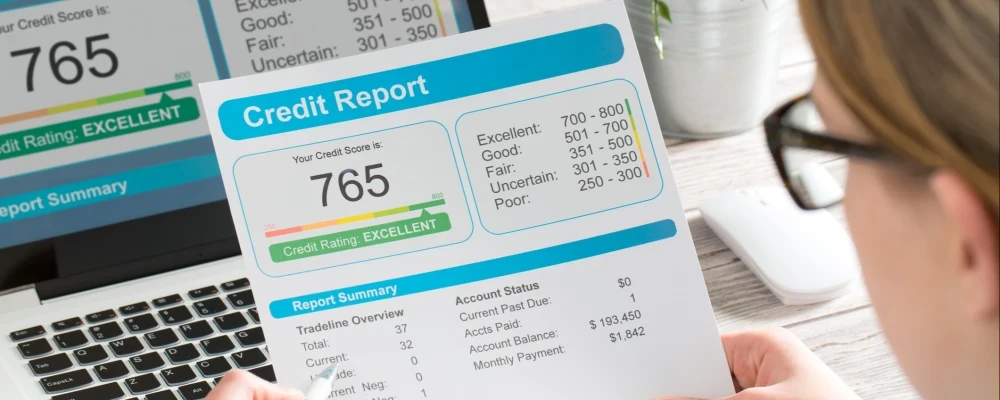

A low credit score makes life much more difficult than it should be. Your FICO number helps determine whether you get a mortgage, credit cards and, sometimes, a job. A low credit score also means you will pay higher interest rates and insurance premiums.

Our content follows strict guidelines for editorial accuracy and integrity. Learn about our and how we make money.

A low credit score makes life much more complicated than it should be. Your FICO number helps determine whether you get a mortgage, credit cards, and, sometimes, a job. A low credit score also means you will pay higher interest rates and insurance premiums. Sadly, a low score negatively affects many aspects of your life. Fortunately, you can "fix" your score, just not overnight. It takes good planning and a concentrated effort, but it can happen. You can start today by taking some simple steps.

1. Research Your Credit Report

You need to look at your credit report from all three major credit bureaus, Experian, Equifax, and TransUnion, and make sure they are accurate. Sometimes, your score is being affected by misinformation, including debts you no longer owe. Remember, you do not lower your score when you check it yourself, although when lenders make an inquiry, it will slightly lower the score. You can see your credit report for free by going to AnnualCreditReport.com.

2. Challenge Inaccuracies

If you find incorrect information on your credit report, attack it. Dig through your records, check your bank statements, and call and/or write the agencies with proof. Correcting your record can be time-consuming, but It is well worth it to raise your FICO score.

3. Automatic Payments/Payment Reminders

Sometimes late payments are the result of poor organization. Life is busy, and you may forget. If your payment is late or you skip one altogether, it negatively affects your credit score. You can combat this issue by setting a reminder on your computing devices and phone to send the payment. Alternatively, you can set up automatic payments through your bank account. That way, your payments are always on time.

4. Talk with Lenders

If you know you'll be missing a payment, try contacting your lender ahead of time. Sometimes, they will make a one-time accommodation for you. In any event, you'll be more likely to avoid going to collections if you keep a dialogue going with your creditors.

5. Pay Current Debts First

You may have old debts currently in collections. No one likes being chased by debt collectors, but experts caution that staying current with live accounts is more important to your score than paying off old ones. The written-off accounts have already done the damage to your credit, so your focus should be on keeping current accounts up-to-date. Old credit problems eventually fade off of your record, and lenders focus more on your recent payment history.

6. Pay Down Your Debt

Work on paying down your current debt so that you lower your utilization score. Lenders like you to qualify for significant limits but only use a small percentage of your available credit. The top credit scores usually go to people who use only about 10% of their available credit amounts. Be warned, though, that opening several new credit card accounts to expand your limits is not a good idea. This method can lower your scores.

7. Don't Close Unused Credit Cards

In most instances, you should keep your unused credit accounts open. If you close them, it lowers the amount of available credit and can also lower your utilization score. You should only consider closing them if you are paying a yearly fee for the account.

8. Rehabilitate Your Revolving Credit Score

Opening a new credit card and using it responsibly can help rehabilitate your credit score. You must make payments on time and carry a low balance. You may want to pay the card off every month. Your credit score will slowly improve if you establish a new record of responsible credit use. To get a new credit card, you might have to choose one that is for people in an unfortunate credit situation. In these instances, the yearly or monthly fee and interest rate may be higher than average.

9. Understand the Consequences

Only time can heal a weak credit report, but some things stay on your record longer than others. Delinquencies and judgments show up for seven years. A bankruptcy may remain there for as long as ten years. Other negative items drop off after a few years. Again, your most recent credit history is the most important. If you have a judgment but have a clean record for the last five years, lenders will be more likely to extend you credit.

10. Visit a Credit Advisor

If you have chronic credit issues, consider visiting a credit advisor. These professionals can help you create a realistic budget and show you how to tackle your credit issues. A credit advisor differs from those companies that offer to fix your credit for a fee. In general, those companies are not a friend to people with credit issues. A low credit score does not have to be a life sentence. You can begin the work to improve it today. You won't see immediate improvement, but over the next year, your numbers should be trending upward. Make an effort to work on this issue every month, and in a year or two, your score may have risen to new heights.