State Farm Auto Insurance Review

Our content follows strict guidelines for editorial accuracy and integrity. Learn about our and how we make money.

State Farm is the oldest and largest insurance company in the U.S. Founded in 1922, the company has grown into a national insurer that has an annual revenue of $79.39 billion.

State Farm also has over 18,000 insurance agents across the country.

The State Farm company offers a wide variety of insurance products, including:

Vehicle insurance.

Motorcycle insurance.

Boat insurance.

Off-road vehicle insurance.

Homeowners insurance.

Renters insurance.

Life insurance.

Disability insurance.

Small business insurance.

If you’re looking for auto insurance and are wondering whether State Farm is the right company for you, read our State Farm insurance review to find out everything you need to know about them.

Is State Farm a Good Insurer?

As the oldest insurance company in the U.S, customers can rest assured that State Farm is reliable and financially sound.

They have received an A++, the highest possible approval rating, from A.M. Best. This indicates that they have a stable financial outlook and favorable business profile.

Customer Complaints

The National Association of Insurance Commissioners' Complaint Index is a database of customer complaints that allows consumers to compare the customer feedback received by various insurance companies.

Based on the number of complaints in the National Association of Insurance Commissioners Complaint Index, State Farm received a lower than the average level of complaints when compared to insurance companies of a similar size.

The average score for auto insurance companies on the National Association of Insurance Commissioners' Complaint Index is 1, while State Farm scored 0.97.

Customer Satisfaction

ConsumerAffairs has given State Farm a 3.8 out of 5 star rating in their overall customer satisfaction rating based on 611 ratings at the time of publishing.

Some of the reviews have highlighted the following aspects of State Farm’s customer service and claims handling:

Positive customer service experience.

Efficient claims handling.

Affordable rates.

Good communication.

Claims Handling

If you need to submit an insurance claim with State Farm, you can contact them in the following ways:

Call them at 800-SF-Claim (800-732-5246).

Visit State Farm’s website and submit an online claim.

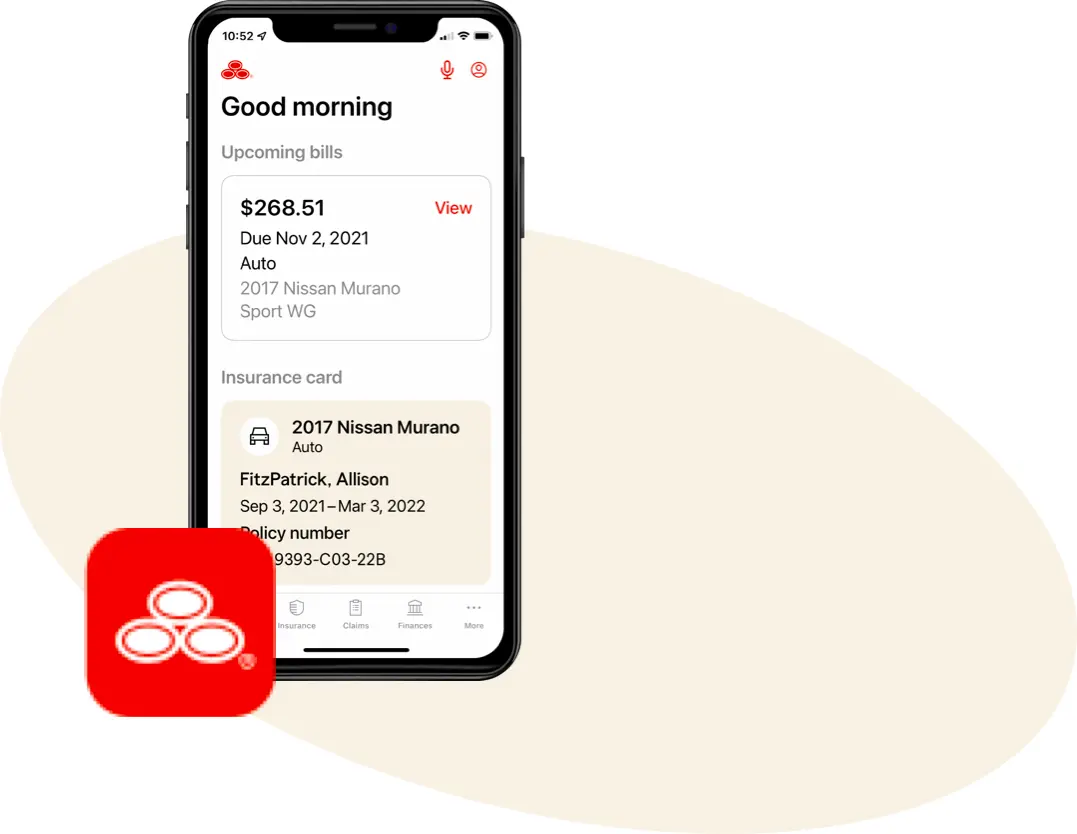

Download the State Farm app and submit a claim.

Contact your State Farm agent.

Along with the various easy digital options State Farm offers for submitting a claim, they also were awarded an above-average score by J.D Powers, indicating that most of their customers are satisfied with the claiming process.

Customer Loyalty

In 2022, the brand loyalty and customer engagement global leader, Brand Keys, announced State Farm as the winner in the Brand Keys Silver Anniversary Customer Loyalty Engagement Index (CLEI).

This award is given based on the insurer meeting their customers’ expectations and gaining loyalty from their followers.

State Farm doesn’t offer customer loyalty discounts. This means the insurer doesn't give discounts based on the length of time a customer has had a policy with them.

However, they do offer discounts to those who show their loyalty by purchasing more than one insurance product from them. These discounts are:

Multiple Auto SavingsIf two or more of the cars in your household are covered by State Farm, you may be eligible for a discount on your policy premium.

Bundle and SaveIf you purchase additional insurance policies (such as homeowners insurance or life insurance) in addition to your auto insurance, you may qualify for a discount on the total cost of your insurance premium.

State Farm’s Drive Safe & Save Program™

Like many auto insurance companies, State Farm offers their customers a usage-based optional add-on to their car insurance, the Drive Safe & Save Program™.

Terms you need to know -

Usage-based insurance programs track your driving habits and assign you points for good behavior. If you practice good driving habits, this could result in discounts on your insurance rate.

Some of the ways insurers track your driving habits include:

A telematics device installed in your vehicle.

Through the insurer’s mobile app.

Through the “infotainment” systems available in newer car models.

Along with receiving a discount on your insurance rates when you sign up, you can save another 30% at the end of your policy renewal period (which is usually at the end of 12 months) if you’ve practiced safe driving habits such as:

Using your vehicle less frequently.

Following the speed limit.

Not using your phone while driving.

Braking and accelerating at a steady pace.

Avoiding late-night driving.

Taking corners at a reasonable speed.

If you have bad driving habits, State Farm won’t automatically increase the cost of your insurance rates. However, you won’t receive the full 30% discount at the time of your policy renewal.

The Benefits and Limitations of State Farm Auto Insurance

Benefits of State Farm

✅ As one of the largest and oldest insurance companies in the country, they are a reliable and financially sound insurance company.

✅ They have over 18,000 insurance agents nationwide.

✅ State Farm offers optional rideshare insurance coverage for drivers who use their car for Uber or Lyft.

✅ Drivers may be eligible for a range of insurance discounts.

✅ They offer multi-policy bundling, allowing you to access cheaper insurance rates if you take out multiple insurance policies with them (for example, auto insurance and homeowners insurance).

Limitations of State Farm

❌ State Farm insurance rates for drivers with a poor credit history are significantly more expensive than the national average.

❌ Their auto insurance policies are not available in Massachusetts or Rhode Island.

Remember -

If you use your car to participate in rideshare programs such as Uber or Lyft, you and your passengers won’t be covered by your standard insurance policy if you are in an accident while working.

Rideshare insurance is a unique type of optional add-on that fills the coverage gap to protect you and your passengers.

State Farm Car Insurance Coverage, Additional Coverage, and Features

Most leading insurance companies offer a range of optional coverages in addition to their standard auto insurance policies.

Below, we will look at State Farm’s standard policies along with some of the additions they offer.

Remember, adding optional coverage to your auto insurance policy will increase the cost of your insurance rates.

State Farm Standard Auto Insurance Coverage

CollisionThis will help to pay for the repairs or replacement of your car if it’s damaged or destroyed in a collision with another car, even in the case of at-fault accidents.

ComprehensiveThis is the most extensive type of car insurance you can purchase and it will cover your car against theft, hijacking, accidents, and fire.

LiabilityLiability insurance is an insurance policy that will help you pay for injury or damage you may cause while driving.

Car rentalIf you frequently rent cars and don’t want to pay the high insurance rates offered by car rental companies, you can get car rental insurance through State Farm.

Travel expensesIf you are in an accident more than 50 miles from home and you cannot drive your car, this State Farm insurance add-on will cover you for meals, accommodation, and transport back home.

Uninsured motor vehicle coverageIf you are in an accident with a driver who does not have insurance, this add-on will cover your medical payments, lost wages, and other expenses related to injuries sustained in the accident.

Underinsured motor vehicle coverageSome drivers may have liability insurance, but not enough to fully cover your medical bills, lost wages, or damages to your car. This insurance policy add-on will cover the shortfall, ensuring you don’t need to pay for these expenses from your own pocket.

Medical payments coverageThis insurance policy add-on will cover the policyholder if they are injured in a car accident, no matter who is responsible for the accident. It includes injuries sustained while you are in another person’s car or using public transport.

Emergency road service coverageIf you have State Farm’s emergency roadside coverage, they will pay for emergency services in the event of a breakdown or accident. This includes mechanical or locksmith labor, towing, and delivering a battery, gas, or tire.

Rideshare driver coverageIf you use your car to drive for Uber, Lyft, or another ridesharing program, the State Farm rideshare insurance add-on will provide coverage for damage to your car, injuries to passengers, and medical coverage.

State Farm Auto Insurance Rates

Most drivers will find that State Farm insurance premiums are below the national average for car insurance.

They also offer an affordable insurance rate for those who are considered high-risk drivers. However, State Farm’s car insurance rates for drivers with a poor credit history are almost $900 higher than the national average.

Remember -

Car insurance companies use the term 'high-risk' to describe drivers who are more likely to claim from their car insurance policy.

An insurer may flag you as a high-risk driver for a range of reasons, including:

Young and inexperienced drivers.

Drivers with a poor credit history.

Drivers with a DUI on their record.

Being in an at-fault accident.

Remember, each driver’s auto insurance rates will be unique and vary based on a combination of the following factors:

Age.

Driving record.

Location.

Credit.

The value of your car.

Car insurance history.

Make sure you compare quotes from different insurers before you decide to sign up for a policy to ensure you’re able to find the lowest premium and the insurance policy most suitable for you.

We’ve compared the rates offered by State Farm to the national average for these types of drivers to help you find the lowest insurance rate based on the kind of driver you are:

Teen drivers.

Young drivers.

Adult drivers.

Senior drivers.

Drivers with a speeding ticket.

Drivers who have caused a car accident.

Drivers with a DUI record.

Drivers with a poor credit record.

State Farm Insurance Rates for Teen Drivers

Almost all car insurance companies in the U.S charge a higher premium when providing coverage for teen drivers.

This is because teen drivers have less driving experience, are more likely to drive late at night and on weekends, and may practice distracted driving (such as texting and driving).

We’ve compared the rates offered by State Farm for teen drivers to the national average and found that their insurance is typically between 35% and 40% cheaper than average.

Teen drivers who are males pay a higher car insurance premium than females, both at State Farm and according to the national average.

| 17-Year-Old Female | 17-Year-Old Male | |

|---|---|---|

| State Farm | $3,233 | $3,958 |

| National Avg | $4,962 | $5,661 |

State Farm Insurance Rates for Young Drivers

Owing to their increased driving experience, drivers who have reached their mid-twenties generally pay lower insurance rates than teen drivers.

State Farm’s auto insurance rates are between 24% to 27% lower than the national average, making them an affordable option for young adult drivers.

If you have recently turned 25 years old and have had a car insurance policy since you were a teen driver, you’ll likely be able to find a lower insurance premium if you update your policy details or switch to a different insurance company.

| 17-Year-Old Female | 17-Year-Old Male | |

|---|---|---|

| State Farm | $3,233 | $3,958 |

| National Avg | $4,962 | $5,661 |

| 25-Year-Old Female | 25-Year-Old Male | |

| --- | --- | --- |

| State Farm | $1,367.69 | $1,527.61 |

| National Avg | $1,734 | $1,842 |

State Farm Insurance Rates for Adult Drivers

Adult drivers in their mid-thirties are generally able to secure lower insurance rates than teen drivers and young adult drivers. Both male and female drivers are able to get State Farm car insurance for 23% lower than the national average.

| 35-Year-Old Female | 35-Year-Old Male | |

|---|---|---|

| State Farm | $1,234 | $1,234 |

| National Avg | $1,476 | $1,485 |

State Farm Insurance Rates for Senior Drivers

Senior drivers who have reached 65 years or older pay even lower insurance rates than teens, young adults, and adult drivers.

This is because senior drivers are less likely to engage in risk-taking behavior, are less likely to drive late at night, and are more likely to spend time at home.

Once senior drivers are over 75 years old, they are likely to see their car insurance rates increase again. This is due to age-related changes in their fitness, vision, and driving ability.

State Farm offers male and female senior drivers the same insurance rates, which are anywhere between 22% to 22% lower than the national average for the same age group.

| 65-Year-Old Female | 65-Year-Old Male | |

|---|---|---|

| State Farm | $1,120 | $1,120 |

| National Avg | $1,332 | $1,365 |

State Farm Insurance Rates After a Speeding Ticket

Receiving a speeding ticket can lead to your car insurance rates increasing, but that doesn’t mean you won’t be able to find affordable car insurance.

State Farm’s car insurance for drivers who have received a speeding ticket is 35% lower than the national average.

| Rate After Receiving a Speeding Ticket | |

|---|---|

| State Farm | $1,409 |

| National Avg | $1,911 |

State Farm Insurance Rates After an Accident

Being in a car accident is one of the factors that may cause insurance companies to classify you as a high-risk driver, particularly if you were found to be at-fault in the accident.

If you have a car accident on your record, State Farm is a good insurance option as their rates are 30% lower than the national average.

| Rate After An At-Fault Accident | |

|---|---|

| State Farm | $1,516 |

| National Avg | $2,180 |

State Farm Insurance Rates After a DUI

Receiving a DUI will almost always result in a significant increase in your car insurance rate. If you receive more than one DUI, your insurance rate will increase accordingly with each new conviction, and your driver’s license may even be suspended or revoked for multiple convictions.

State Farm offers affordable rates for drivers with a DUI, at 52% lower than the national average.

| Rate After Receiving a DUI | |

|---|---|

| State Farm | $1,711 |

| National Avg | $2,601 |

State Farm Insurance Rates for Drivers with Poor Credit

If you have a poor credit history, you will generally pay a higher rate for car insurance. While State Farm offers affordable insurance for other types of high-risk drivers, their car insurance for drivers with poor credit is 33% higher than the national average.

If you have a poor credit history, you are likely to find cheaper insurance rates if you compare quotes from other car insurance companies.

| Rate For Drivers with Poor Credit | |

|---|---|

| State Farm | $3,654 |

| National Avg | $2,757 |

Types of Auto Coverage

Minimum CoverageAlmost every state in the U.S requires drivers to carry a minimum amount of coverage.

These minimums are set because getting into a car accident can be costly, especially if you injure someone or damage their property.

Paying for repairs, replacements, or medical bills can cost thousands of dollars—money that most people don’t have readily available.

These minimums apply not only to protect other drivers, but also to protect the policyholder from debt or even bankruptcy.

High CoverageHigh coverage (also called “full coverage insurance” or “comprehensive insurance”) policies provide more comprehensive protection for you and your car.

This increased protection comes with a higher price tag though, as these policies are usually more expensive than minimum coverage policies.

How Much Is Minimum Coverage Car Insurance With State Farm?

State Farm offers some of the lowest minimum coverage car insurance rates in the country, and is 22% cheaper than the national average.

| Rate For Minimum Coverage | |

|---|---|

| State Farm | $1,191.25 |

| National Avg | $1,463 |

How Much Is High Coverage with State Farm?

State Farm’s high coverage rates are 17% below the national average, making them a good insurance option for drivers who want comprehensive coverage at an affordable rate.

| Rate For High Coverage | |

|---|---|

| State Farm | $1,348.45 |

| National Avg | $1,621.76 |

Auto Insurance Discounts Through State Farm

Like many leading insurance companies, State Farm offers their policyholders the opportunity to lower their insurance premium by taking advantage of discounts.

If you are considering signing up with State Farm, make sure you ask your insurance agent which discounts you are eligible for to maximize your savings.

Keep in mind that many of these auto insurance discounts (for example, the accident-free discount) depend on having good driving behavior and can be revoked.

Accident-free discount

If your car is insured for three years with State Farm and you do not cause a car accident, you will be eligible for this discount.

Defensive driving discount

Taking an advanced driving course is a great way to save on your insurance premiums.

Many defensive driving courses are expensive, so make sure to weigh up the cost in comparison to your potential insurance savings.

Good student discount

If you are a student driver and achieve a GPA of at least 3.0, you will be eligible for their good student discount.

Bundle policies

Bundling policies refers to getting multiple insurance policies from the same company. If you get homeowners insurance, renters insurance, or a life insurance policy in addition to your State Farm car insurance, you will be able to take advantage of this discount.

Good driver discount

If you are not in an at-fault accident and do not receive any speeding tickets or commit driving violations for three years, you can get a good driver discount.

Student away at school discount

If you have a child who is a student listed as an additional driver on your policy, you will receive a discount if they only use the car while they’re visiting home.

Driver training discount

Young drivers who are under 21 years old can complete an accredited driver safety course to take advantage of this discount.

Vehicle safety

If your car was manufactured in or after 1994, you can get a vehicle safety discount.

Passive restraint

If your car was manufactured in or before 1993 and has airbags, you may be eligible for the passive restraint discount.

Anti-theft

If you have installed an anti-theft device in your car, you may qualify for this discount. Before having a device installed, make sure to check which devices are eligible with your insurer.

Multi-car discount

If you have more than one car insured with State Farm, you can benefit from their multi-car discount.

State Farm Auto Insurance vs. Competitors

| State Farm Auto | Nationwide Auto | USAA | Geico | |

|---|---|---|---|---|

| State Availability/ Service Areas | Not available in Massachusetts or Rhode Island. | Not available in Alaska, Hawaii, Louisiana, and Massachusetts. | Available in all 50 U.S states and Washington, D.C. | Available in all 50 U.S states and Washington, D.C. |

| 2021/ 22 J.D. Power study ranking | 885/1,000 | 859/1,000 | 881/1,000 | 769/1,000 |

| AM Best rating | A++ | A+ | A++ | A++ |

| Better Business Bureau (BBB) rating | A+ | A+ with accreditation | A- | A+ |

The PolicyScout Final Verdict

After reading our State Farm auto insurance review, you’re likely wondering whether State Farm is the best insurer for you.

They offer a wide range of discounts and optional insurance coverage add-ons that can benefit specific types of drivers, such as:

Drivers who need rideshare insurance.

Teen drivers.

Young adult drivers.

Drivers with a DUI.

However, if you have a poor credit score, you may be able to find an insurance provider that can offer you lower rates than State Farm.

State Farm is a reputable insurer that has received consistently high customer satisfaction scores and positive ratings from financial institutions.

This is indicative of their positive reputation, making them a reliable option for almost every kind of driver.

Frequently Asked Questions (FAQs) about State Farm Auto Insurance

Is State Farm considered a good insurance company?

Yes. State Farm is a reliable insurer with a positive reputation. They offer competitive rates on most of their auto insurance policies, along with discounts and flexible coverage add-ons.

Is State Farm known for denying claims?

No. State Farm has received consistently high customer satisfaction scores and positive ratings from financial institutions like AM Best and BBB, indicating that they do pay out valid claims.

Does State Farm offer gap insurance?

No, they do not offer gap insurance. However, all State Farm policyholders will automatically become part of their Payoff Protector program. This will cancel the outstanding balance on your loan if your car is totaled.

Get Affordable Car Insurance Tailored to Your Needs

Need help selecting the right car insurance policy for your needs? Over the years, PolicyScout has formed relationships with the most reputable insurance companies in order to ensure we can help you get the best rate on your policy.

Give us a call at 1-888-912-2132 or send us an email at Help@PolicyScout.com for assistance.