Our 2022 Allstate Auto Insurance Review

Read our full 2022 Allstate Auto Insurance review to find out if this is the right auto insurer for you.

Our content follows strict guidelines for editorial accuracy and integrity. Learn about our and how we make money.

Founded in 1931, Allstate Auto Insurance is one of the largest car insurance companies in the U.S., with over 16 million customers.

Allstate is known for its extensive range of car insurance coverage options, the variety of discounts it offers to its customers, and its exclusive savings programs.

The insurance company also offers two roadside assistance plans starting from as little as $7 per month.

Allstate Auto Insurance is available nationwide, and they have local agents available in every state if you want to speak to one.

Although we will discuss this in more detail later on, one drawback is that Allstate has lower reviews and customer satisfaction scores than some other car insurance companies.

Other than car insurance, Allstate also offers life insurance, home insurance, business insurance, identity protection, and phone protection.

Is Allstate Car Insurance Good?

Allstate is a good option if you are looking for an accessible, one-stop auto insurance company.

Their expansive reach and wide variety of insurance products make you more likely to find the right car insurance coverage for your needs.

Let’s take a closer look at what Allstate Auto Insurance offers to its customers so that you can decide if they are the right auto insurer for you.

Allstate’s Customer Service Reviews And Ratings

This insurance company has many contact options if you need assistance.

They have a mobile app, live chat, and several different departments that you can phone or email.

If you are interested in buying an Allstate car insurance policy, you can use their online search locator to find an agent near you:

Source: allstateagents

Alternatively, you can speak to one of at PolicyScout’s insurance agents about the different options available and which is best for you.

The Allstate mobile app is useful for customers because they can use it to:

Pay premiums.

View policies.

Access insurance cards.

Upload claim photos.

Locate a mechanic.

File a claim.

The app can also be used to contact an Allstate agent if you need extra help or information.

Although there are many ways to contact Allstate, their customer service has consistently ranked lower than other car insurance companies, especially between 2019 and 2021.

Customer service ratings are important because you would want to choose a car insurance company that treats its customers well.

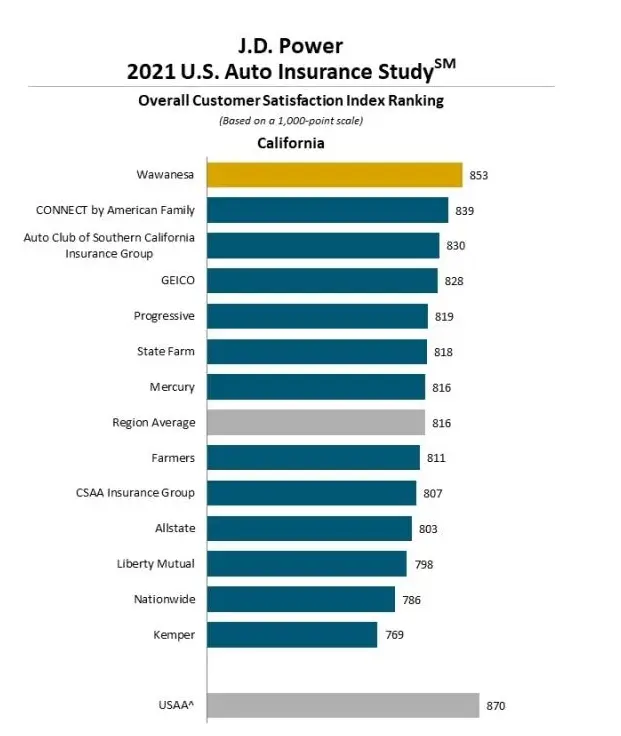

JD Power is a consumer research firm in the U.S. Each year, they publish a study that ranks different auto insurance companies based on their customer satisfaction scores.

In JD Power’s most recent study, the 2021 U.S. Auto Insurance Study, Allstate Auto Insurance scored 803 points out of 1,000 points. The average score for car insurance coverage companies in the study is 816. This means that Allstate’s JD power rating is only slightly above average.

Here is a graph showing where Allstate ranks in the JD Power study:

Source: JDPower

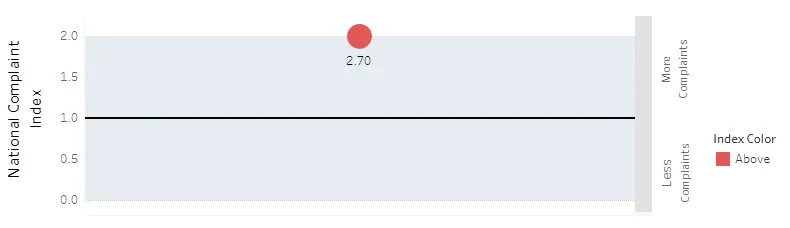

Another company called the National Association of Insurance Commissioners (NAIC) also gives insurance providers a customer satisfaction score based on customer complaints.

The baseline score for NAIC is 1.0. Anything lower is above average or good; anything above 1.0 means the company gets more than the average customer complaints.

Allstate’s NAIC complaint index score is 2.70 in 2022, meaning they’ve received many more complaints than other insurance companies.

Here is Allstate’s Auto Insurance NAIC complaint index score:

Source: NAIC

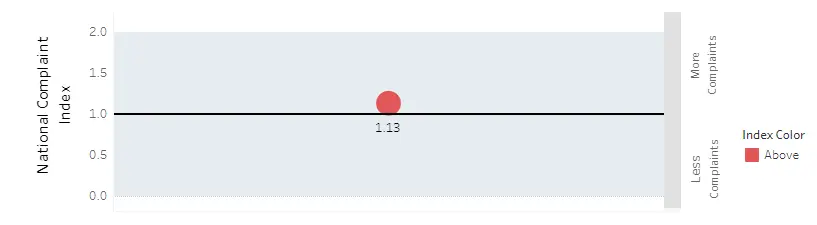

Geico, another large insurance company in the U.S. and a close competitor of Allstate, has an NAIC complaint index score of 1.13, as you can see below:

Source: NAIC

How Allstate car insurance handles claims

Allstate is known for being good at handling and paying out claims on its car insurance policies.

Customers can either file a claim on the claims section of the Allstate website, via the Allstate mobile app, or by calling their local agent.

The car insurance provider also has something called a claims satisfaction guarantee. If their customers are unhappy with the service they received during the claims process or their payout experience, they get six months of credit toward their premium.

This shows that Allstate Auto Insurance is committed to making sure that they handle claims well and that their customers are happy with the payout process.

Allstate’s customer loyalty

Customer loyalty is all about how likely customers are to renew their insurance policy with Allstate and how likely they are to recommend the company to people they know, who are shopping for car insurance coverage.

US News recently did a survey of Allstate’s customers. They found that 44% of Allstate customers who have never filed a claim say they will renew their policy, and 37% said they are very likely to recommend Allstate Auto Insurance to others.

Around 38% of people who have filed a claim with Allstate said they would recommend them, and 46% said they would renew their insurance policy with the car insurance company.

Added benefits and programs

Besides Allstate having over 10 different auto insurance discounts, it also offers its members two exclusive savings programs.

The first program is called Drivewise, where Allstate insurance customers get discounts based on how well they drive.

Drivewise works by having a device installed in your car that collects information about how you drive. You can get up to 40% off your Allstate car insurance premium if you drive well.

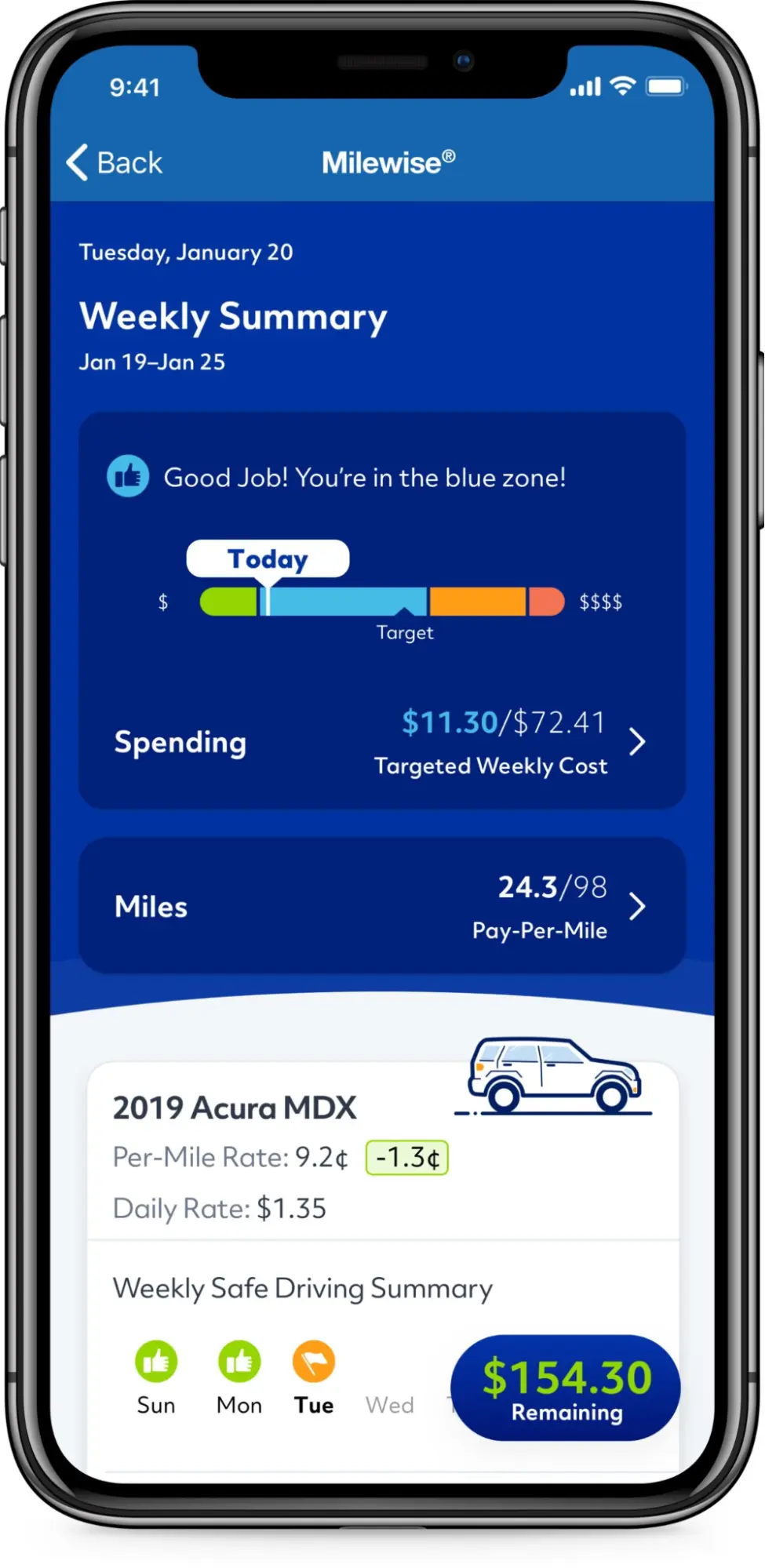

If you are an Allstate customer and you can choose to download one of two of their mobile apps, Milewise and Drivewise. You can earn safe driving points that you can use to get discounts on various products through their Allstate rewards program.

This is what the Drivewise mobile app looks like:

Source: repairer driver news

This program is only available in 28 U.S. states, including:

| Arkansas. Arizona. Colorado. Connecticut. Florida. Hawaii. Illinois. Indiana. Louisiana. | Kentucky. Massachusetts. Maryland. Michigan. Minnesota. Missouri. Mississippi. New Jersey. New Mexico. | Nevada. New York. Ohio. Oklahoma. Oregon. Pennsylvania. Tennessee. Utah. Washington. |

The second benefit program that Allstate offers is called Allstate Milewise. This is a pay-per-mile service that charges customers a base rate and a per-mile rate.

Allstate’s base rate is charged like traditional insurance policies that consider your age, gender, location, and driving record, and the per-mile rate is usually a few cents per mile.

Allstate Milewise is only available in the following states:

| Arizona. Delaware. Florida. Idaho. Illinois. Indiana. Maryland. Massachusetts. Minnesota. Missouri. New Jersey. | Ohio. Oklahoma. Oregon. Pennsylvania. South Carolina. Texas. Virginia. West Virginia. Washington. Wisconsin. |

Allstate’s Benefits And Limitations

It’s always a good idea to look at an auto insurance company's pros and cons to see if they offer the best coverage options.

✅ Pro: Many coverage options to choose from

Allstate Auto Insurance offers almost all kinds of auto insurance, and they have many plans and policies for customers to choose from.

They also offer car insurance for unique needs like classic car insurance and car insurance in Mexico.

Remember -

Classic car insurance is for drivers who own a classic or collectible car.

These types of cars will often need special types of transport if they need to be towed.

Classic cars are investments and need a different kind of insurance coverage compared to the cars we drive daily.

✅ Pro: Plenty of discounts

Allstate Auto Insurance offers over 10 different discounts that you can get if you fit certain profiles.

For example, if you have recently bought a car, you could qualify for a new car discount, meaning your premium will be less.

We will tell you more about Allstate car insurance discounts later in this article.

✅ Pro: Many roadside assistance options

Compared to other auto insurance companies, Allstate Auto Insurance takes roadside assistance very seriously. They offer 24/7 roadside assistance, which is the help that you can get if your car breaks down or if you need a tow while on the road.

Their Roadside Advantage plan is only $7 per month and offers 24/7 protection for local and minimal driving. With this plan, you can get three rescues per year, including jump starts, fuel delivery, lockout assistance, and tire changing.

Allstate’s Roadside Elite coverage is $12 per month and offers five rescues per year, as well as all the other services mentioned above.

❌ Con: Poor customer service rankings and reviews

As we mentioned earlier, Allstate Auto Insurance doesn’t have the best customer satisfaction reviews. Some of their scores are below average, and the number of complaints they receive is high.

❌ Con: Roadside assistance at an additional fee

Although Allstate’s roadside assistance programs are great, they are not a free part of any of their insurance policies.

You will have to pay an additional $7 or $12 monthly to get roadside coverage from Allstate.

Most auto insurance providers have roadside coverage included in a traditional car insurance policy.

❌ Con: Six-month terms

Most car insurance companies offer a year-long insurance policy. But Allstate only offers policies on a six-month term.

This means that you will have to renew your Allstate policy every six months, which can be a hassle and may also mean that you pay a different car insurance premium each time you renew.

Allstate Car Insurance Coverage and Additional Coverage

Allstate insurance offers most types of car insurance coverage that are available in America. Let’s take a closer look at each type of insurance so you can decide what kind of coverage you need.

Liability coverage

Allstate offers liability coverage. Liability insurance comes in two parts:

Bodily injury liability: This is insurance coverage for any medical bills that may arise for injuries caused by a car accident. This coverage is for other drivers or passengers, not for you.

Property damage liability: This type of insurance coverage pays for any damage you cause to the property of others in a car accident. It will cover damage to another car or surrounding buildings.

Liability insurance is for any costs that happen if an accident is your fault. It can even cover the other driver's death and any legal costs.

Collision coverage

This type of insurance is for any damage to your car in the event of an auto accident. Where liability insurance pays for other drivers’ cars, collision coverage pays for your vehicle specifically.

There may be a collision deductible on your Allstate policy, which is an amount of money you will have to pay out of your own pocket toward the cost of the repairs or replacement of your car.

Comprehensive coverage

Allstate offers comprehensive coverage. Comprehensive insurance pays for any damage to your car that isn’t the result of an actual car accident.

This type of damage can include theft, fire, vandalism, natural disasters such as earthquakes or floods, and if you hit an animal while driving.

Personal injury protection (PIP) coverage

Allstate also offers personal injury protection (PIP), which pays for any medical costs that may arise for you or for your passengers if you are injured in a car accident.

Currently, 16 U.S. states require that you must have PIP when you own a car.

Underinsured or uninsured motorist coverage

If you get into a car accident with a driver who does not have car insurance or is underinsured, this type of insurance will pay for the repair or replacement of your car, as well as medical bills.

This type of insurance is also for if you are involved in a hit-and-run. Currently, uninsured or underinsured motorist coverage is required by law in 20 states. In other words, if you own a car, you must have this type of coverage if you live in one of these states.

Personal umbrella policy

This is an extra type of coverage that not all car insurance companies offer. If you need additional coverage for anything that falls outside of the limits of your standard Allstate policy, this will fall under an umbrella policy.

Rental reimbursement coverage

Another type of extra car insurance coverage that Allstate offers is called rental reimbursement coverage. Essentially, this means that if your car is too damaged to drive in an accident or if it is stolen, you will be given a rental car to drive until you receive your new or repaired car.

In other words, if you can’t drive your car because it is damaged or lost, you will have transport until your insurance policy pays out.

Rideshare insurance

If you drive for a ride-hailing company like Uber or Lyft, you will need to have rideshare insurance. This coverage can be added to your existing car insurance policy.

Rideshare insurance covers everything that the ridesharing company you work for would not cover in the case of a car accident.

This insurance covers you during the period that you are driving while waiting for a ride request.

How Much Does Allstate Car Insurance Cost?

The cost of Allstate’s car insurance will depend on your age, your location, your gender, how long you have been driving, how old your car is, your credit history, and if you’ve recently been in any accidents or received a speeding fine.

US News recently did a study where they researched how much Allstate car insurance costs for different age groups and for those that have recently had accidents or who have poor credit.

Let’s take a look at what US News found in their study about Allstate car insurance rates.

Car insurance premiums for teen drivers

Usually, auto insurance for teenage drivers is the most expensive kind of insurance you can get. Allstate’s rates for teen drivers are much higher than the national average rates of insurance for this age group.

| Insurance Company | 17-Year-Old Female | 17-Year-Old-Male |

|---|---|---|

| Allstate | $6,607 | $7,441 |

| National Average | $4,860 | $5,503 |

Care insurance premiums for young adult drivers

Again, Allstate’s insurance premiums are higher than the national average for young adult drivers—over 10% higher in fact. This means that Allstate isn’t the most affordable option for this age group of drivers.

| Insurance Company | 25-Year-Old Female | 25-Year-Old-Male |

|---|---|---|

| Allstate | $2,262 | $2,352 |

| National Average | $1,628 | $1,713 |

Car insurance premiums for adult drivers

While auto insurance for adult drivers is usually a lot more affordable than teen or young adult drivers, this is not the case with Allstate. Their insurance premiums for adult drivers are up to 19% higher than the national average.

| Insurance Company | 35-Year-Old Female | 35-Year-Old-Male |

|---|---|---|

| Allstate | $1,992 | $1,978 |

| National Average | $1,388 | $1,397 |

Car insurance premiums for senior drivers

Once again, Allstate’s car insurance premiums are higher than other insurance companies when it comes to senior drivers. Their rates for seniors are over 20% higher than the national average, making them one of the more expensive insurers for senior drivers.

| Insurance Company | 60-Year-Old Female | 60-Year-Old-Male |

|---|---|---|

| Allstate | $1,827 | $1,869 |

| National Average | $1,245 | $1,282 |

Car insurance premiums after a speeding ticket

If you have recently received a speeding ticket, your insurance premiums can be more expensive. If you have a speeding ticket on your record, Allstate can charge you up to 22% more for your premium versus other insurers.

| Insurance Company | Rate After One Speeding Ticket |

|---|---|

| Allstate | $2,326 |

| National Average | $1,767 |

Car insurance premiums after an accident

With most insurance companies, your premium will be higher than for other drivers if you have recently been involved in a car accident, especially if the accident was your fault. If you have an accident on your record, Allstate will charge you up to 30% more than other insurance companies would for your premium.

| Insurance Company | Rate After One Accident |

|---|---|

| Allstate | $2,828 |

| National Average | $2,041 |

Car insurance premiums after a DUI

If you have a driving under the influence (DUI) offense on your record, you can expect to pay much higher premiums with any auto insurer. This is because auto insurance providers view DUIs as very reckless driving.

Drivers with a DUI on their record can expect to pay up to 16% more on their premium with Allstate Auto Insurance compared to the national average.

| Insurance Company | Rate After One DUI |

|---|---|

| Allstate | $3,017 |

| National Average | $2,320 |

Car insurance premiums for drivers with poor credit

If you have a poor credit score, car insurance companies will usually charge you a higher premium than other drivers, because there is the risk that you may not be able to pay your premium. With Allstate, drivers with poor credit can pay up to 17% more than the national average.

| Insurance Company | Rate For Drivers With Poor Credit |

|---|---|

| Allstate | $3,017 |

| National Average | $2,320 |

Types Of Allstate Auto Insurance Coverage

Most U.S. states require drivers to have a certain amount of insurance coverage, which is called minimum coverage. You can visit your state’s department of motor vehicles (DMV) to find out the minimum coverage you need.

How much is minimum coverage with Allstate?

Much like all their other rates, Allstate’s minimum coverage premiums are higher than the national average. The national average for insurance companies offering minimum coverage is $1,372, and Allstate’s premium is $1,961.

How much is high coverage with Allstate?

If you want more than the minimum coverage in your state, this is called high coverage or maximum coverage.

High or maximum coverage means you have more protection for damage and medical bills than you would if you only had minimum coverage.

You might want to consider high coverage if you want to pay less for your deductible when you make a claim.

Allstate’s high or maximum coverage premiums are 32% more expensive than the national average, which again means they have more expensive insurance premiums than many other companies.

The national average for high coverage is $1,518, and Allstate’s auto insurance rate for high coverage is $2,138.

Allstate Auto Insurance Discounts

As we mentioned before, Allstate has some great discounts for its members if you meet certain criteria. You may qualify for a discount if you:

Have a car that is brand new.

Choose to have more than one insurance policy with Allstate, like insuring another car or having home insurance with the company.

Earn good grades at high school or college.

Have anti-lock brakes installed in your car, this is called an anti-lock brake discount.

Have a car with an anti-theft device installed.

Drive safely, which lowers your risk.

Sign up for a new policy seven days before it becomes effective.

Make your payments on time for a year.

Pay your premiums through automatic withdrawals.

Enroll for Allstate’s paperless statements through eSmart.

Pay your policy in full up front.

Allstate Auto Insurance vs. Competitors

If you are considering becoming an Allstate Auto Insurance member, it’s important that you do your research first. You should definitely compare more than one auto insurance provider to Allstate before you make your decision.

Let’s take a look at some of Allstate’s closest competitors and the ratings they have received.

| National Average | Allstate Auto | Nationwide Auto | State Farm | Geico | |

|---|---|---|---|---|---|

| State Availability/ Service Areas | Nationwide | Nationwide | Nationwide | Nationwide | Nationwide |

| J.D. Power study ranking | 816 | 803 | 787 | 817 | 853 |

| AM Best rating | N/A | A+ | A+ | A++ | A++ |

| Better Business Bureau (BBB) rating | B | A | A+ | A | A+ |

Our Final Verdict

It’s clear that Allstate Auto Insurance is a lot less affordable than other insurance companies when it comes to its premiums.

But the insurer provides more coverage options and more discounts than most insurance companies.

Something else to consider is that Allstate does not have customer satisfaction ratings that are as high as its competitors.

However, they do have a satisfaction guarantee that could cover your premium for six months if you aren’t happy with their customer service during the claims process.

If you need any assistance with choosing auto insurance companies or if you would like more information, you can reach us at 1-888-912-2132 or send an email to Help@PolicyScout.com to get help from one of our trained consultants.

Frequently Asked Questions (FAQs) about Allstate Auto Insurance

Is Allstate good about paying claims?

Allstate Auto Insurance is known for being good about paying out claims to its members, and it has a claims satisfaction guarantee where they will pay part of your premium if you are not happy with the way they’ve handled your claim.

Who should get Allstate car insurance?

Allstate car insurance is available to all drivers, regardless of where you live, your age, or your gender. The age group that would find the lowest Allstate premium is senior Americans.

Where can I get Allstate car insurance?

You can get Allstate car insurance by visiting their website, downloading their mobile app, or contacting a local agent.